Remuneration

Finnair's remuneration policies and the remuneration of personnel are described in this section, especially remuneration for senior management such as members of the Board of Directors, the CEO, and members of the Executive Board. The content covers the requirements of the Finnish Corporate Governance Code 2025.

(Approved by an advisory vote in the AGM in March 2025)

Principles and decision-making add

Remuneration at Finnair is based on the principles of performance, fairness and competitiveness. Remuneration shall support the achievement of Finnair´s strategic goals and sustainability strategy, align the management’s priorities with the interests of Finnair´s shareholders, encourage behaviour consistent with Finnair’s values, and reward excellent performance. These principles apply to the CEO and the rest of the personnel, as stated in Finnair’s internal Compensation Policy for personnel.

Remuneration is designed to attract and retain desired talent, motivate the delivery of the company’s strategy and maximise shareholder value creation. The targets and rewards in the incentive systems are balanced between long-term value creation and efficient achievement of short-term goals.

Remuneration Governance

The Board of Directors' remuneration

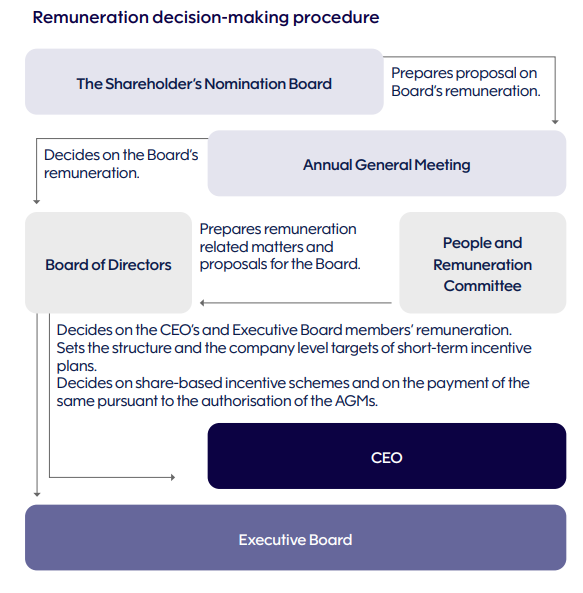

The Shareholders’ Nomination Board is tasked with proposing the remuneration for members of the Board of Directors at the AGM. The proposal shall be based on the principles defined in the Directors’ Remuneration Policy. The AGM makes the final decision on the Board of Directors’ remuneration.

Remuneration of the CEO and the Executive Board

The Board of Directors, with the assistance of its People and Remuneration Committee, reviews and approves the remuneration principles for the CEO as defined in the Directors’ Remuneration Policy. The Board of Directors also decides on the CEO’s salary, incentive schemes and associated targets based on preparatory work by the People and Remuneration Committee.

Usually, the CEO participates in the People and Remuneration Committee’s meetings, except for matters relating to the CEO’s remuneration and other terms of service.

Remuneration and decision-making procedure

Remuneration of the Board of Directors add

The Annual General Meeting (AGM) decides annually on the remuneration and other financial benefits of the members of the Board of Directors and its committees. The election and remuneration of the members of the Board are prepared by the Nomination Board formed by the representatives of the company’s largest shareholders. The remuneration of the Board of Directors and its committees is paid in cash and shares. The non-executive members of the Board of Directors are not eligible to participate in the same share-based incentive plans or other incentive plans as the executive management.

The 2025 Annual General Meeting decided on the board's remuneration in accordance with the proposal of the shareholders' nomination committee as follows:

- Chair EUR 80,000 (2024: EUR 72,000) per year;

- Vice Chair EUR 48,000 (2024: EUR 39,000) per year; and

- Member EUR 40,000 (2024: EUR 35,000) per year.

Fixed fees for Committee work

Chairs of the Audit Committee and the People and Remuneration Committee are paid EUR 6,000 (2024: EUR 6,000) per year, and the members of the Committees EUR 3,000 (2024: EUR 3,000) per year. Similar fixed fees are paid to the Chairs and members of other permanent Committees possibly established by the Board of Directors.

Meeting fees

A meeting fee of EUR 800 (2024: EUR 800) is paid to the members of the Board of Directors participating in a Board or Committee meeting when the meeting takes place in the member’s country of residence, and EUR 3,200 (2024: EUR 3,200) for other meetings. For remote and telephone meetings, the meeting fee is EUR 800 (2024: EUR 800).

The members of the Board of Directors are entitled to reimbursement of reasonable travel expenses in accordance with the Company’s general expenses policy.

The members of the Board of Directors and their spouses are entitled to discounted travel on the Company’s flights in accordance with the Company’s discount ticket policy regarding the Board of Directors.

The remuneration of the Board of Directors in the financial year 2025 is reported in the Remuneration Report.

Remuneration of the CEO add

The Board of Directors decides on the salary, incentive plans and associated targets of the CEO and other members of the Executive Board based on preparatory work carried out by the People and Remuneration Committee.

When determining remuneration elements, the Board of Directors considers aspects it deems relevant to the Company’s best interests, including, significant shareholders’ remuneration principles, shareholders’ and other investment market stakeholders’ views on remuneration and relevant market and peer group remuneration practices. The Board evaluates how to best observe these views and principles in the Company’s interest at any given time.

| Base Salary | The CEO’s monthly base salary is 59,250 euros. |

| Benefits | Phone benefit, company car benefit, staff ticket benefit, life insurance and a right to health insurance |

| Short Term Incentive (STI) plan | Performance period: 12 months. Performance criteria defined annually by the Board of Directors. Incentive opportunity: in 2026, target 40% / maximum 80% of annual base salary. To support the successful implementation of its strategy, Finnair’s Board of Directors has introduced an additional strategy accelerator feature to the short term incentive (STI) plan for 2026 for the CEO and a small number of other key management members who have direct and critical role in driving Finnair’s financial results, operational performance and strategy acceleration. The measured STI outcome of the CEO and the other eligible leaders may by a separate decision of the Board be multiplied by 1.5 for the final STI payout. Despite the multiplier, the total variable pay actually paid to the CEO and any other employee within a year, in accordance with Finnair’s Remuneration Policy, may not exceed 200% of the individual’s annual base salary. |

| Long Term Incentive (LTI) plan | Performance period: 3-year plans commencing annually Performance criteria defined separately by the Board of Directors for each 3-year-plan. Incentive opportunities: The LTI earning opportunity is determined annually by the Board of Directors. The combined annual STI and LTI pay-out is limited to 200% of annual base salary. Shares allocated to the CEO from the on-going Performance Share Plan are listed under the Variable compensation section. |

| Share ownership requirement | The members of the Executive Board are expected to retain at least fifty percent of the net shares received based on the LTI plans until their share ownership in Finnair corresponds to at least their annual gross base salary. |

| Supplementary Pension | None |

| Insurances | Free-time accident insurance, travel insurance, management liability insurance, life insurance and right to medical insurance. |

| Termination of the service contract and severance pay | The notice period is six months for both the company and the CEO. In the event that the company terminates the service contract, the CEO is entitled to a severance payment corresponding to a total salary for six months (base salary + taxable value of benefits) in addition to the salary for the notice period. |

The salaries and bonuses paid to the CEO during the financial year 2025 are reported in the Remuneration Report.

Remuneration of the Executive Board, excluding CEO add

| Base Salary | Fixed monthly salary based on position |

| Benefits | Phone benefit, company car benefit, staff ticket benefit, life insurance and a right to health insurance |

| Short Term Incentive (STI) plan | Performance period: 12 months Performance criteria defined annually by the Board of Directors Incentive opportunities: in 2025, target 30% / maximum 60% of annual base salary |

| Long Term Incentive (LTI) plan | Performance period: 3-year programs commencing annually Performance criteria defined annually by the Board of Directors Incentive opportunities: The LTI earning opportunity is determined annually by the Board of Directors. The combined annual STI and LTI pay-out is limited to 200% of annual base salary. |

| Share ownership requirement | The members of the Executive Board are expected to retain at least fifty percent of the net shares received based on the LTI plans until their share ownership in Finnair corresponds to at least their annual gross base salary. |

| Supplementary Pension | One executive Board member who joined before 1 January 2013 has a defined contribution benefit (10% of TyEL salary). Executive Board members whose service contracts have been concluded after 1 January 2013 do not have supplementary pension benefit. |

| Insurances | Free-time accident insurance, travel insurance, management liability insurance, life insurance and right to medical insurance. |

| Termination of the service contract and severance pay | The maximum notice period is six months for both parties. In the event that the company terminates the agreement, the member of the Executive Board is, depending on the employment contract, entitled to a severance pay corresponding to the base salary of a maximum of twelve months in addition to the salary for the notice period. |

Remuneration paid to the members of the Executive Board in 2024

| Remuneration paid, euros per year | Executive Board 2024 | Executive Board 2023 |

|---|---|---|

| Base salary (1) | 1,828,773 | 2,049,650 |

| Benefits (2) | 80,197 | 92,125 |

| Short Term Incentives (3) | ||

| Based on last year's performance | 958,103 (Based on 2023 Performance) |

62,775 (Based on 2022 Performance) |

| Long Term Incentives (4) | ||

| Executive Board Long Term Incentive Plan, monetary and share reward, euros | 0 (Incentive Plan 2021-2023 was cancelled for the Executive Board) | 0 (Incentive Plan 2020-2022 was cancelled for the Executive Board) |

| Executive Board Rebuild, monetary and share reward, euros (5) | 727,288 Based on 7/2020–6/2023 performance |

1,737,482 Based on 7/2020–6/2023 performance |

| Fly Share, monetary and share reward, euros | 700 | 12,203 |

| in total, euros | 727,988 | 1,749,686 |

| Supplementary pensions | 40,184 | 31,977 |

| Remuneration paid in total | 3,635,245 | 3,986,213 |

(1) Base salary including holiday bonus.

(2) Benefits include company car, phone, staff tickets and possible voluntary health insurance.

(3) Short Term Incentive Plan 2022 was cancelled for the CEO and Executive Board members. One Executive member is entitled to Short Term Incentive 2022 bonus paid in 2023 from the time she was not an EB member.

(4) Long Term Incentive Plans 2020–2022 and 2021–2023 were cancelled for the CEO and Executive Board members.

(5) Rebuild Plan was paid in 2023 according to 120 percent yearly pay gap to the Executive Board 2023. The part exceeding the 120% gap was paid in 2024.

Variable remuneration add

Variable remuneration shall support the achievement of Finnair´s strategic goals and sustainability strategy, align the management’s priorities with the interests of Finnair’s shareholders, encourage behaviour consistent with Finnair’s values, and reward excellent performance. Performance targets for the CEO and members of the Executive Board are set by Finnair’s Board of Directors. The maximum combined value of STI and LTI paid in a year is limited to 200% of the annual base salary.

Short-term incentives (STI)

The STI plan aims to drive short-term (annual) performance against specific targets based on key strategic priorities for the year. Performance criteria are set annually by the Board of Directors based on the key priorities for the financial year. These may include financial and non-financial criteria, such as but not limited to sustainability-related metrics.

In 2026, for the CEO, the target level of incentive compensation is 40%, and the maximum level is 80% of base salary. For other executive team members, the target level is 30% and the maximum level 60% of base salary.

To support the successful implementation of its strategy, Finnair’s Board of Directors has introduced an additional strategy accelerator feature to the short term incentive (STI) plan for 2026 for the CEO and a small number of other key management members who have direct and critical role in driving Finnair’s financial results, operational performance and strategy acceleration.

The measured STI outcome of the CEO and the other eligible leaders may by a separate decision of the Board be multiplied by 1.5 for the final STI payout. Despite the multiplier, the total variable pay actually paid to the CEO and any other employee within a year, in accordance with Finnair’s Remuneration Policy, may not exceed 200% of the individual’s annual base salary.

Profit-sharing plan (Personnel fund)

Finnair has had a Profit-sharing plan in which a share of Finnair’s profits is allocated to its personnel. The shares of personnel working in Finland have been directed to a personnel fund owned and controlled by the personnel, and the shares of personnel working outside Finland have been paid through normal salary payments. Finnair’s CEO and other members of the Executive Board have been excluded from the profit-sharing plan, as have the persons covered by the Performance share plan.

No targets have been set for the profit-sharing plan during years 2021–2025.

Performance Share Plan (PSP)

Finnair has a performance-based, share-based incentive scheme for a limited number of top management and key employees. The purpose of the scheme is to encourage participants to increase shareholder value in the long-term, and to commit them to the company.

The individual share plans starting annually include a three-year performance period. An exception to this was the two-year performance period, that covered years 2023–2024. The Plan offers participants the opportunity to earn Finnair shares as a long-term incentive reward if the performance targets set by the Board for the scheme are met. The potential rewards will be delivered to the participants in shares and cash in the year following the performance period and they are at the participants’ free disposal after delivery. The members of the Executive Board are expected to retain at least fifty percent of the net shares received based on the LTI plans until their share ownership in Finnair corresponds to at least their annual gross base salary.

The shares are taxable income, and taxes are deducted from the gross number of shares. The remaining net shares are delivered to the participants’ book-entry accounts.

A person is not entitled to the share reward if he or she resigns or if a notice of termination is given before the date of payment. The Board of Directors is also entitled, subject to a particularly weighty reason, to change or cancel the incentive or to postpone its payment. The Board of Directors is entitled to remove a participant from the share plan if the person has committed a significant offence or acted in a manner detrimental to the company or contrary to the company’s interests.

Restricted Share Plan

The aim of the Restricted Share Plan is to function as a complementary share-based incentive tool to combine the objectives of shareholders with those of the persons participating in the plan and to commit the participants to Finnair. The plan offers participants an opportunity to receive a predetermined number of company’s shares after a specific restriction period.

The Restricted Share Plan consists of annually commencing individual restricted share plans. The Board of Directors will decide separately on the commencement of each individual plan. Each plan comprises an overall three-year restriction period during which the company may grant fixed share rewards to individually selected key employees. The company may choose to use a shorter restriction period on a case-by-case basis within this overall three-year period. The granted share rewards will be paid after the restriction period. No reward will be paid if the participant’s employment or service ends, or a notice of termination is delivered before the reward payment.

On-going Performance Share Plans (updated 13 October 2025):

| Plan | 2023–2025 | 2024–2026 | 2025–2027 |

| Number of participants | 63 | 69 | 68 |

| The maximum number of shares payable1 | |||

| CEO | 36,244 | 106,104 | 389,980 |

| Other participants | 362,614 | 876,621 | 2,058,160 |

| Total | 398,858 | 982,725 | 3,000,000 |

| Performance criteria | EBIT%, 100% weight | Free Cash Flow, 20% weight Earnings Per Share, 60% weight CO2/RTK, 20% weight |

Earnings Per Share, free cash flow, CO2 emissions per revenue tonne kilometre (fuel efficiency, CO2/RTK) and employee engagement score |

1The maximum amount of gross shares to be paid (including taxes) if the performance criteria are fully met.

Performance criteria and achievements of the plans already ended:

| LTI plan | Performance criteria | Achievement |

|---|---|---|

| 2018 – 2020 | Earnings Per Share (EPS), 50% weight Revenue growth, 50% weight |

22% of maximum 200% |

| 2019 – 2021 | Earnings Per Share (EPS) Revenue growth Unit cost (CASK) constant fuel price and currencies |

54% of maximum 200% |

| 2020 – 2022 | Earnings Per Share (EPS) Unit cost (CASK) constant fuel price and currencies |

0%. The plan was cancelled for the Executive Board. |

| 2021 – 2023 | Earnings Per Share (EPS), 45% weight Unit cost (CASK) constant fuel price and currencies, weight 45% CO2 (Fuel Efficiency), 10% weight |

0%. The plan was cancelled for the Executive Board. |

| 2020 – 2023 Rebuild for Executive Board and personnel | Multiplier based on Net cash flow from operating activities 7/2020-6/2023 2020-2021: Comparable EBITDA, 40% weight; Gearing-%, 40% weight; Lost Time Injury Frequency (LTIF), 10% weight; CO2 (Fuel Efficiency), 10% weight 2021-2022: Comparable EBIT, 60% weight; Revenue, 20% weight; Retention, 10% weight; CO2 (Fuel Efficiency), 10% weight 2022-2023: Comparable EBITDA, 40% weight; Net Promoter Score (NPS), 40% weight; Lost Time Injury Frequency (LTIF), 10% weight; Attrition Rate, 10% weight |

69,5% of maximum 100% |

| 2023 – 2024 | Earnings before interest and taxes (EBIT), weight 100% | 100% of maximum |

Previous remuneration reports add

Finnair Directors' Remuneration Report 2024

Finnair Remuneration Statement 2023

Finnair Directors' Remuneration Report 2022

Finnair Directors' Remuneration Report 2021

Finnair Directors' Remuneration Report 2020

Finnair Remuneration Statement 2019

Finnair Remuneration Statement 2018

Finnair Remuneration Statement 2017

Statement on the CEO’s supplementary pension

Finnair Remuneration Statement 2016

Finnair Remuneration Statement 2015

Finnair Remuneration Statement 2014

Finnair Remuneration Statement 2013